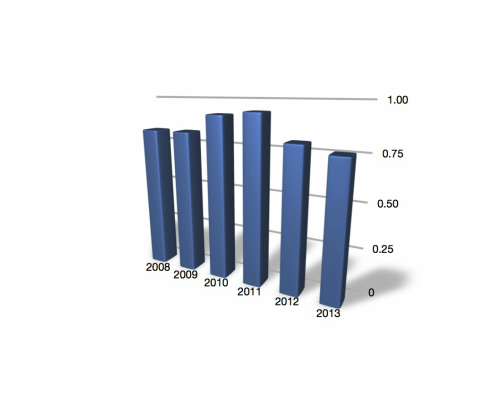

Quality’s Safety Rating Is Excellent

We have a great EMR rating which has steadily improved over the last five years. Contact us regarding our Safety program.

Just What Is An Experience Modification Rate?

Experience modifier or experience modification is a term used in the American insurance business and specifically in workers’ compensation insurance. It is the adjustment of annual premium based on previous loss experience. Usually three years of loss experience are used to determine the experience modifier for a workers’ compensation policy. The three years typically include not the immediate past year, but the three prior.

Experience modifier or experience modification is a term used in the American insurance business and specifically in workers’ compensation insurance. It is the adjustment of annual premium based on previous loss experience. Usually three years of loss experience are used to determine the experience modifier for a workers’ compensation policy. The three years typically include not the immediate past year, but the three prior.

The experience modifier adjusts workers compensation insurance premiums for a particular employer based on a comparison of past losses of that employer to what is calculated to be “average” losses of other employers in that state in the same business, adjusted for size. To do this, experience modifier calculations use loss information reported in by an employer’s past insurers. This is compared to a calculation of expected losses for a company in that line of work, in that particular state, and adjusted for the size of the employer. The calculation of expected losses utilizes past audited payroll information for a particular employer, by classification code and state. These payrolls are multiplied by Expected Loss Rates, which are calculated by rating bureaus based on past reported claims costs per classification.